Content

The proposed amendment mandates that the revenue from this tax be used for public education and infrastructure repair and maintenance. It further states that spending would be subject to appropriation by the state legislature. Critics argue that this condition gives the legislature free reign to manipulate spending of the new revenue. The possibility that legislators may use the language as an opportunity to direct state funds to other programs seems remote, at least early on. Many legislators would face repercussions if they blatantly ignored the will of a majority of the state’s voters.

A key question on the ‘millionaires tax’: What makes you a millionaire? – The Boston Globe

A key question on the ‘millionaires tax’: What makes you a millionaire?.

Posted: Tue, 25 Oct 2022 09:41:00 GMT [source]

Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. For a full schedule of Emerald Card fees, see your Cardholder Agreement. Available at participating offices and if your employer participate in the W-2 Early Access℠ program. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Most state programs available in January; release dates vary by state. Payroll Payroll services and support to keep you compliant.

Massachusetts Targeting Digital Advertising Services for Taxation

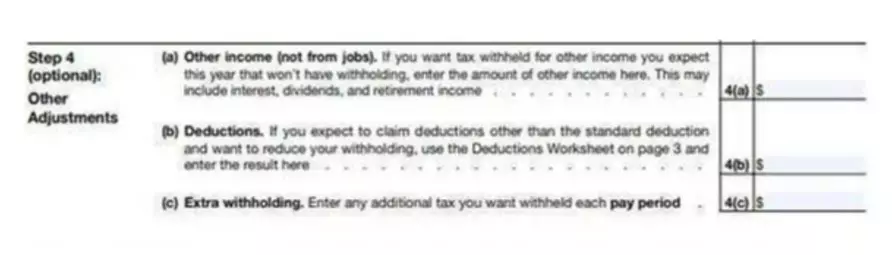

It is also possible to request that no taxes be withheld. However, if no taxes are withheld, you should submit estimated quarterly payments to the IRS. You maychange your federal tax withholding amountat any time during your retirement simply by notifying us.

Interest or dividends received from Massachusetts banks or corporations will generally not be Massachusetts source income assuming that such items are not connected with a business activity of the student. Scholarship or fellowship grants not requiring the rendition of services should also not be deemed Massachusetts source income as no trade or business is involved. Full-year and part-year residents could be subject to MA income tax. In fact, if you earn an income of $8,000 in the state, you should pay file a return and pay state income tax. Nonresidents of Mass. file returns is their gross income is over $8,000 or prorated personal exemption whichever is less. Learn what income is calculated and who should pay the state income tax on Mass.gov. It’s up to you to negotiate this with your employer.

Corporate income tax

If you are in Massachusetts solely to pursue a course of study over a relatively defined period of time, with an intention to return home at the conclusion of your studies, you will not be deemed to be domiciled in Massachusetts. Bank products and services are offered by MetaBank®, N.A. The course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. Emerald Card Retail Reload Providers may charge a convenience fee.

That’s the 6.2% for Social Security taxes and 1.45% for Medicare taxes that your employer withholds from every paycheck. Any earnings you make above $200,000 are subject to a 0.9% Medicare surtax, which is not matched by your employer. Massachusetts has its own estate tax, which applies to any estate above the exclusion amount of $1 million. massachusetts income tax If the estate has a gross value over that level, a Massachusetts estate tax return must be filed. However, estate tax is only due if the taxable estate exceeds $1 million. The state of Massachusetts has a personal income flat tax rate of 5% for everyone who made over $8,000 in 2021, regardless of their filing or residency status.

Tax policy in Massachusetts

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an https://www.bookstime.com/ amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

62, § 5A, is subject to Massachusetts withholding and taxes. Massachusetts requires employers to withhold Massachusetts personal income tax in connection with wages earned by nonresidents who perform services in Massachusetts. A nonresident employee who, prior to the Pandemic determined MA-source income by apportioning based on days spent working in MA must continue to do so (please see MA 830 CMR 62.5A.3 for this specific rule). “In general, eligible taxpayers will receive a credit in the form of a refund that is approximately 13% of their Massachusetts Tax Year 2021 personal income tax liability,” Baker’s office said in a statement. The governor had earlier predicted that amount would be 7%. Massachusetts partnerships are pass-through entities at both the federal and state levels.

Estimated Tax Payments

Understanding your tax obligation and potential federal deductions you can take. What’s even more time-intensive is how to deduct state tax from your federal taxes as an itemized deduction. This is not an offer to buy or sell any security or interest.

- Gasoline and diesel taxes in Massachusetts each total 24 cents per gallon.

- For most nonresident students, their Massachusetts source income will be limited to compensation from employment in Massachusetts.

- If the employee wishes, as regulations allow, they may elect the exemption from withholding.

- Here you can find how your Massachusetts is based on a flat tax rate.

- H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

If you are a Massachusetts resident, however, your benefit is not subject to state income taxes. At the time of your retirement, we ask you to instruct us whether you want us to withhold any amount for income taxes and, if so, how much. Massachusetts is one of 14 states that levies an estate tax. In addition, residents are liable for the federal estate tax.

While those in favor point to estimates that the surtax could generate $2 billion or more in annual state tax revenue, certain factors could impact this anticipated tax windfall. Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail. Timing is based on an e-filed return with direct deposit to your Card Account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.